Washington LLC and Corporation Registration and Formation

Washington LLC and Corporation Registration and Formation

Today, Washington is considered as a state with a stable economy and great prospects for a start-up business entity. The key businesses or industries thriving in the state include tourism, design and manufacturing of jet aircrafts (Boeing), online retailers like Amazon, Expedia, Inc., biotechnology, computer software development (Microsoft, Valve Corporation, Nintendo of America), lumber, aluminium production, electronics, wood products (Weyerhaeuser), and mining. You can also form a Washington business today and become a part of the growing economy!

You are probably wondering what the process for LLC formation or incorporation is. This is where we can be of help! We as one of the top Washington registered agents can assist you with the successful registration of your business entity in the state.

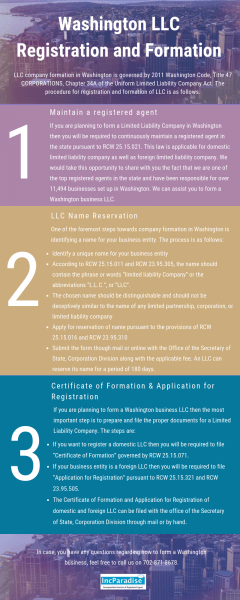

Washington LLC Registration and Formation

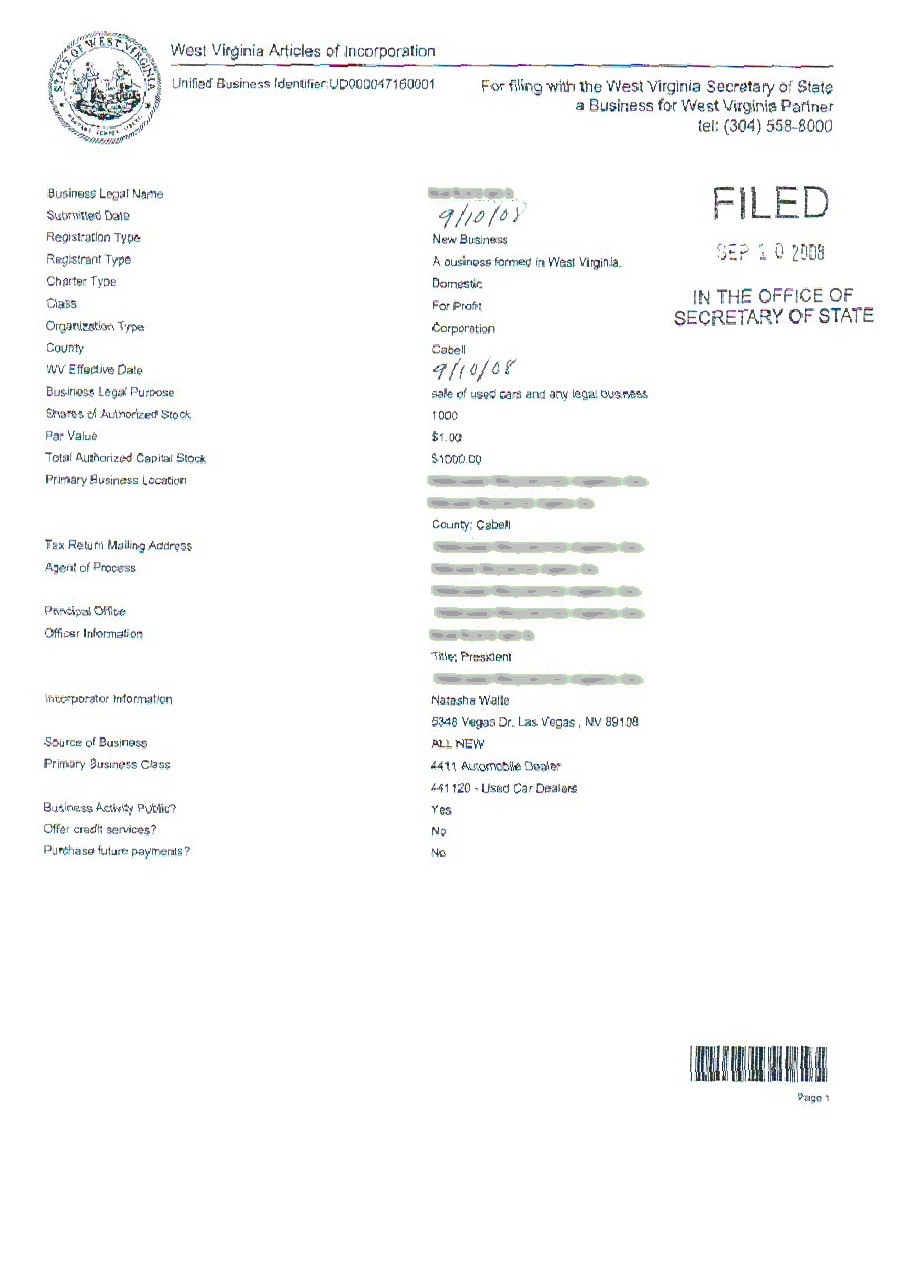

LLC company formation in Washington is governed by 2011 Washington Code, Title 47 CORPORATIONS, Chapter 34A of the Uniform Limited Liability Company Act. The procedure for registration and formation of LLC is as follows:

Step#1: Maintain a registered agent

If you are planning to form a Limited Liability Company in Washington then you will be required to continuously maintain a registered agent in the state pursuant to RCW 25.15.021. This law is applicable to domestic limited liability companies as well as foreign limited liability companies.

We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Washington. We can assist you to form a Washington business LLC.

Step#2: LLC Name Reservation

One of the foremost steps towards company formation in Washington is identifying a name for your business entity. The process is as follows:

- Identify a unique name for your business entity

- According to RCW 25.15.011 and RCW 23.95.305, the name should contain the phrase or words “limited liability Company” or the abbreviations “L.L.C.”, or “LLC”.

- The chosen name should be distinguishable and should not be deceptively similar to the name of any limited partnership, corporation, or limited liability company

- Apply for reservation of name pursuant to the provisions of RCW 25.15.016 and RCW 23.95.310

- Submit the form though mail or online with the Office of the Secretary of State, Corporation Division along with the applicable fee. An LLC can reserve its name for a period of 180 days.

Step#3: Certificate of Formation and Application for Registration

If you are planning to form a Washington business LLC then the most important step is to prepare and file the proper documents for a Limited Liability Company. The steps are:

- If you want to register a domestic LLC then you will be required to file “Certificate of Formation” governed by RCW 25.15.071.

- If your business entity is a foreign LLC then you will be required to file “Application for Registration” pursuant to RCW 25.15.321 and RCW 23.95.505.

- The Certificate of Formation and Application for Registration of domestic and foreign LLC can be filed with the office of the Secretary of State, Corporation Division through mail or by hand.

We can file the form on your behalf as your registered agent in the state and provide you with certified copies of the LLC registration.

In case, you have any questions regarding how to form a Washington business, feel free to call us on 702-871-8678.

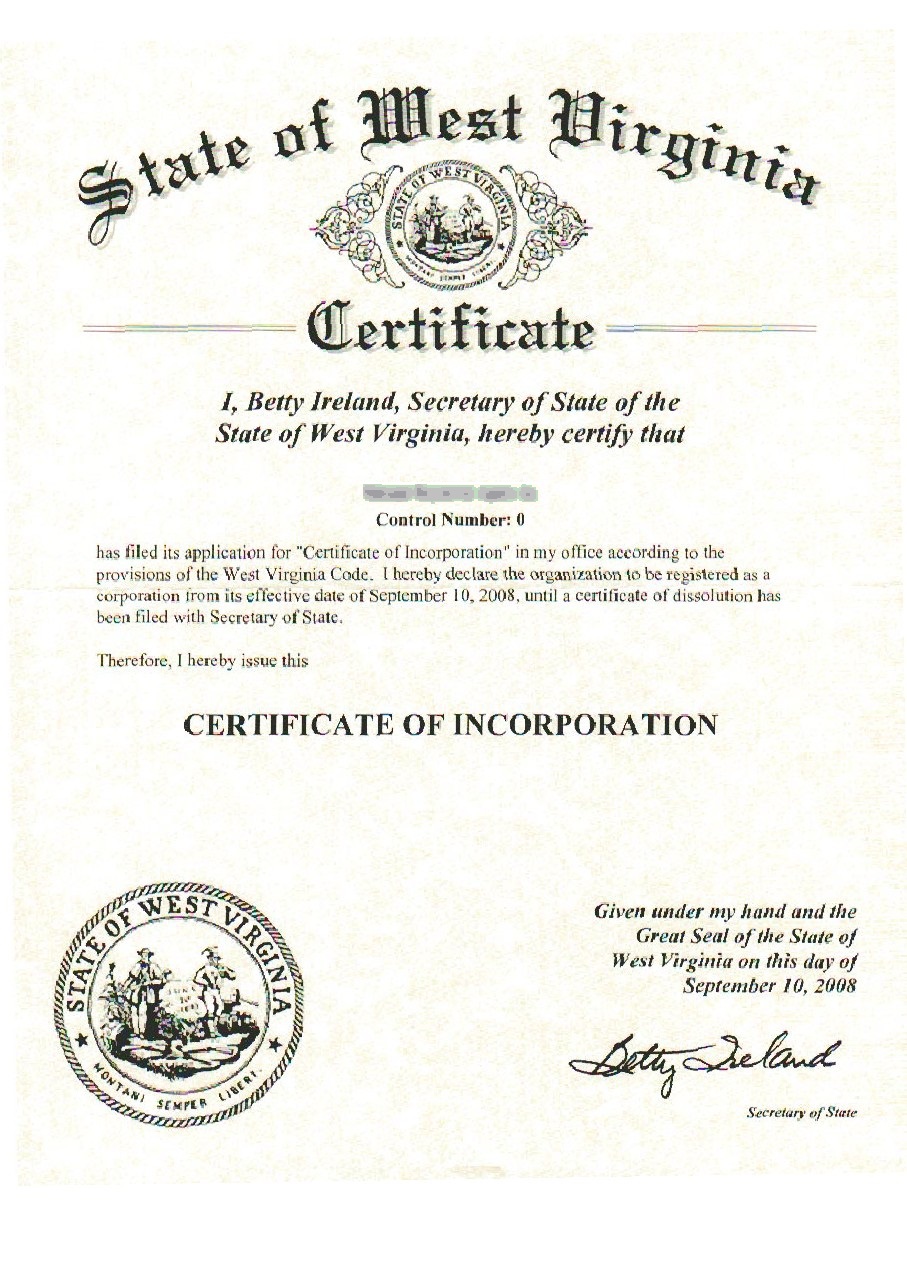

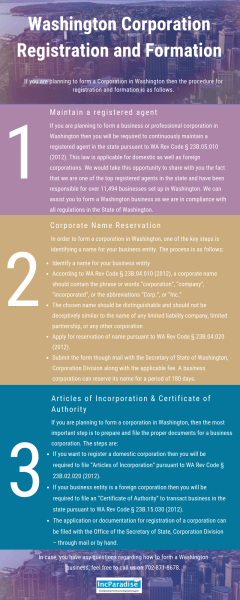

Washington Corporation Registration and Formation

If you are planning to form a Corporation in Washington then the procedure for registration and formation is as follows:

Step#1: Maintain a Registered Agent

If you are planning to form a business or professional corporation in Washington then you will be required to continuously maintain a registered agent in the state pursuant to WA Rev Code § 23B.05.010 (2012). This law is applicable to domestic as well as foreign corporations.

We would take this opportunity to share with you the fact that we are one of the top registered agents in the state and have been responsible for over 11,494 businesses set up in Washington. We can assist you to form a Washington business as we are in compliance with all regulations in the State of Washington.

Step#2: Corporate Name Reservation

In order to form a corporation in Washington, one of the key steps is identifying a name for your business entity. The process is as follows:

- Identify a name for your business entity

- According to WA Rev Code § 23B.04.010 (2012), a corporate name should contain the phrase or words “corporation”, “company”, “incorporated”, or the abbreviations “Corp.”, or “Inc.”

- The chosen name should be distinguishable and should not be deceptively similar to the name of any limited liability company, limited partnership, or any other corporation

- Apply for reservation of name pursuant to WA Rev Code § 23B.04.020 (2012).

- Submit the form though mail with the Secretary of State of Washington, Corporation Division along with the applicable fee. A business corporation can reserve its name for a period of 180 days.

Step#3: Articles of Incorporation and Certificate of Authority

If you are planning to form a corporation in Washington, then the most important step is to prepare and file the proper documents for a business corporation. The steps are:

- If you want to register a domestic corporation then you will be required to file “Articles of Incorporation” pursuant to WA Rev Code § 23B.02.020 (2012).

- If your business entity is a foreign corporation then you will be required to file an “Certificate of Authority” to transact business in the state pursuant to WA Rev Code § 23B.15.030 (2012).

- The application or documentation for registration of a corporation can be filed with the Office of the Secretary of State, Corporation Division – through mail or by hand.

We can file the form on your behalf being your registered agent in the state and provide you with certified copies of the incorporation.

If you have any questions regarding Washington incorporation or LLC formation, you can simply visit the Washington Business formation page.

702-871-8678

702-871-8678