Advantages of Incorporating a Business in North Dakota

Advantages of Incorporating a Business in North Dakota

One of the important factors that make a business environment excellent for new businesses is the incentives and benefits they will enjoy. A start-up company in North Dakota can enjoy a variety of incentives and can get financial aid through grants with ease and this is why the state is ranked high when it comes to “best business environment”. The state enjoys a robust economy where the energy development sector is flourishing; agriculture is still going strong, a variety of financial resources are also easily accessible, there is a high-quality standard of living, and there are highly skilled and motivated workforce. North Dakota is the only state in the nation that is home to a state-owned bank (Bank of North Dakota in Bismarck) and a state-owned flour mill. The second largest Microsoft campus with 1,700 employees is situated in Fargo and ND is currently the largest producer of different types of cereal grains in the nation.

Drivers of Business Growth for Start-ups

Are there any drivers of business growth for a startup company in North Dakota? Yes, there are several different drivers and most of all; it’s the advantages and benefits that a business can derive in the state is what provides the initial thrust. Let’s look at some of the basic advantages that an LLC or business corporation in North Dakota can leverage:

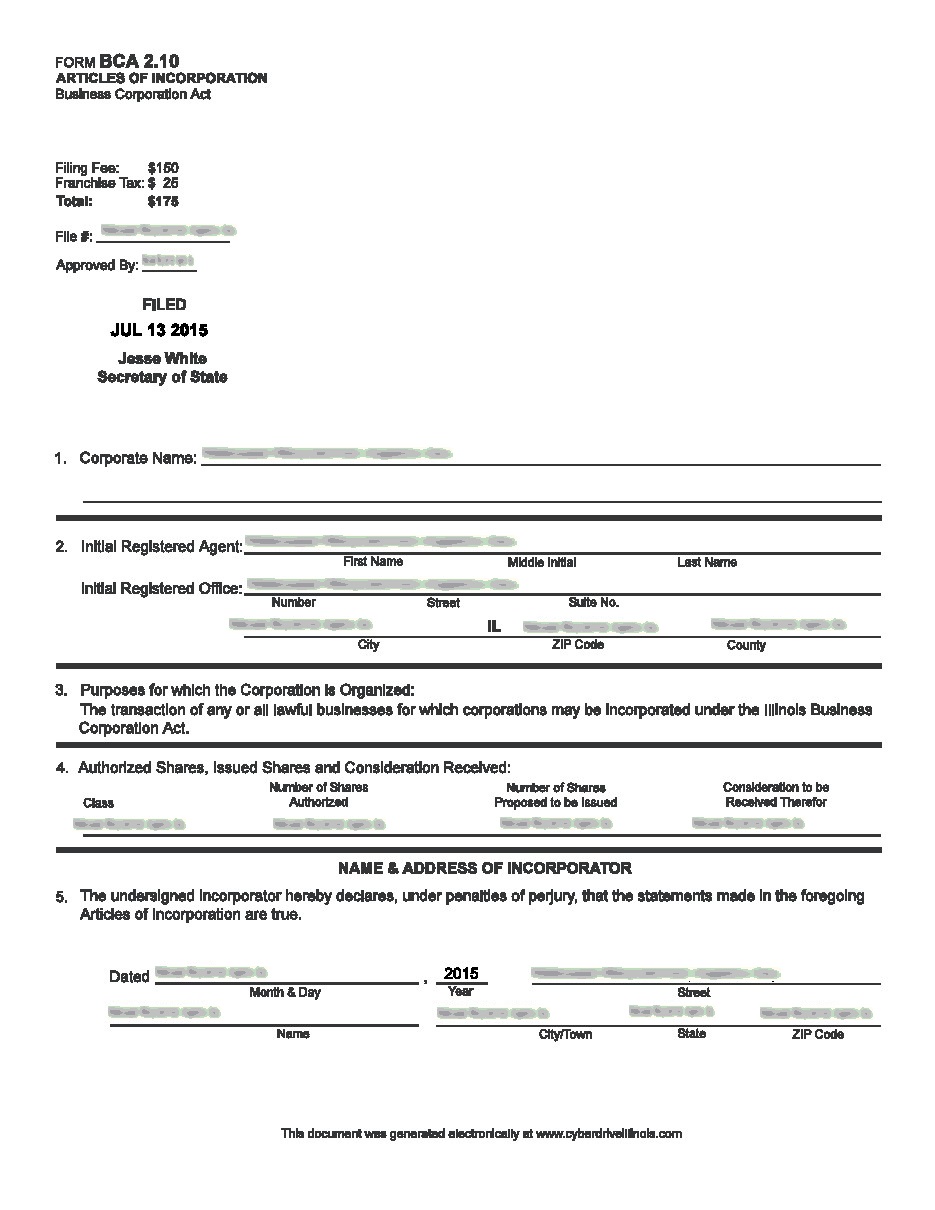

Advantage#1: The benefits of Incorporation or LLC formation

C or S Corporation

- Tax Exemptions: If you register a new company in North Dakota then you will be able to benefit from the variety of tax exemptions available and these include:

– North Dakota exempts different types of items from sales tax normally taxed by other states, like electricity, groceries, and natural gas.

– All personal property is exempted from taxation except certain types of gas refineries and oil utilities.

– There is no tax on items like inventory, office equipment, materials in process, or accounts receivable.

– Primary sector businesses may be eligible for sales and use tax exemption as well as refund on purchase of computer and telecommunication equipment. - Federal taxation: If you register a new company in North Dakota as an S corporation then the corporation or firm will not pay any income tax. Instead, each shareholder or owners in the company will be liable to pay tax on their personal tax returns.

- Independent life: When you register a new business in North Dakota as an S Corporation, it will enjoy an independent life. This means that the incapacitation or death of a stockholder will not have a negative impact on the business operations.

Limited Liability Company

- Sales and Service Tax Exemptions: If you register a new business in North Dakota then it can be eligible for several

types of sales tax exemptions on products and services. Let’s take a look at some of them:

– The products that are exempted in ND from sales tax include Livestock and Poultry Feed, Prescription Drugs, Commercial Fertilizer, Farm Machinery Repair Parts, Seeds for Planting, Gasoline and Combustible Fuels, Food and Food Products, Medical Devices and Equipment, and Used Mobile Homes among others.

– The services that are exempted in ND from sales tax include Transportation Services including public transportation companies, hospital and nursing home Services, and services that involve repairing, restoring, altering, or cleaning tangible personal property.

Note: Rental of Hotel and Motel Accommodations as well as Rental of Mobile Homes are exempt from sales tax under the ND sales and use tax law and is categorized under “Conditional Exemptions”. - Flexible Profit Distribution: A start-up company inNorth Dakota LLC has the benefit of being able to select different ways of distribution of profits unlike a partnership where the distribution is 50-50.

- Limited Liability: As an owner of a North Dakota LLC, you will be able to enjoy limited liability protection quite similar to what a corporation enjoys.

Advantage#2: North Dakota Business Incentives

Once you register a new company in North Dakota, there are several business incentives and programs that your business entity can benefit from. Let’s take a look at some of the most popular programs:

- North Dakota Renaissance Zone: A start-up company in North Dakota as well as its individuals are eligible for leveraging the tax incentives provided under the Renaissance Zone program. The renaissances zones are designated areas situated within a city and are approved by the Department of Commerce Division of Community Services. The tax incentives are available on purchasing or leasing, or making certain improvements to real properties situated in the renaissance zone. There are a variety of tax incentives available including state income tax exemptions, local property tax exemptions, and tax credits. Renaissance Zone Program Guidelines

- New or Expanding Business Income Tax Exemption Program: A tourism business or primary sector business entity is eligible to apply for this tax incentive program. You have to apply to the Corporate Income Tax Section, c/o State Tax Commissioner to benefit from the tax exemption. Download sample application

- Wage and Salary Credit Program: This is a credit program through which a corporation or a start-up company in North Dakota that has set up a business in the state will be allowed income tax credit equal to 1 percent of the salaries and wages paid during the tax year for the first three years of operation. In order to get the tax credit, you will be required to fill and submit Schedule ME.

Are there any Disadvantages of Incorporating in North Dakota?

What disadvantages could possibly be there for a startup company North Dakota? In reality there are none except a few that are common to different types of businesses. For example, processing of incorporation can be time consuming and require more paperwork while LLC formation has the disadvantage of limited life. These are small disadvantages as compared to the many incentives the Flickertail State has to offer.

702-871-8678

702-871-8678